In the realm of personal finance, two terms often surface: Investment Management and Financial Planning. While they are interconnected, they serve distinct purposes and cater to different aspects of an individual’s financial journey. Understanding the nuances between the two can empower you to make informed decisions about managing your finances effectively.

Key Takeaways

- Investment Management is about growing your wealth through strategic investments.

- Financial Planning is about creating a comprehensive strategy to achieve your financial goals.

- Both services are interconnected and should work together for optimal financial health.

- Regular reviews and adjustments are essential to stay on track with your financial objectives.

What Is Investment Management?

Investment Management refers to the professional management of various securities (stocks, bonds, etc.) and assets (real estate, etc.) to meet specified investment goals for the benefit of investors.

Investment management is the professional process of overseeing and handling different types of investments — such as stocks, bonds, real estate, mutual funds, ETFs, and other securities — with the goal of meeting specific financial objectives for individuals, institutions, or organizations. It includes strategic decision-making, continuous evaluation, and active monitoring of financial assets to optimize performance based on an investor’s risk tolerance, time horizon, and investment goals.

Investment management is often provided by financial advisors, asset managers, portfolio managers, or investment firms. It’s a service that can range from basic portfolio guidance to full-scale institutional asset oversight involving billions of dollars.

Key Components:

- Asset Allocation: Deciding the proportion of different asset classes (equities, bonds, real estate) in a portfolio.

- Diversification: Spreading investments across various sectors and instruments to mitigate risk.

- Risk Management: Identifying, analyzing, and taking steps to minimize or control the probability and impact of unfortunate events.

- Performance Monitoring: Regularly reviewing and adjusting the portfolio to ensure it aligns with the investor’s goals.

Components of Investment Management

Portfolio Construction

At the heart of investment management lies portfolio construction — the process of choosing and allocating investments that align with the client’s financial objectives.

- Risk Tolerance Assessment: Understanding how much risk the client is willing and able to take on.

- Investment Objectives: Determining whether the client is seeking income, capital preservation, growth, or a blend of these.

- Time Horizon: A key factor, as longer time horizons typically allow for more aggressive investments.

Asset Allocation

Asset allocation is the strategy of distributing investments across various asset classes — equities, fixed income, real estate, commodities, and cash equivalents.

- Strategic Allocation: Long-term asset mix aligned with goals.

- Tactical Allocation: Short-term adjustments based on market conditions.

- Dynamic Allocation: Continuous adjustments based on changing financial situations or market cycles.

Security Selection

Once the asset classes are chosen, specific investments within each class must be selected:

- For equities: Which companies, industries, and regions?

- For bonds: What maturity dates, interest rates, and credit ratings?

- For funds: Active vs. passive, domestic vs. international?

Managers may use various methods such as fundamental analysis, technical analysis, and quantitative modeling to select securities.

Diversification

This is the principle of not putting all your eggs in one basket. A well-diversified portfolio reduces the risk of significant losses by spreading investments across different instruments, industries, and geographies.

- Reduces unsystematic risk (company-specific or sector-specific risk).

- Balances volatile assets with more stable ones.

Performance Measurement and Reporting

Performance evaluation is crucial to determine how well the investment strategy is working. This is done through:

- Benchmark Comparison: Measuring returns against an appropriate market index (e.g., S&P 500).

- Risk-adjusted Returns: Metrics such as Sharpe Ratio and Alpha.

- Periodic Reviews: Quarterly or annual meetings to assess portfolio health.

Rebalancing

Over time, due to market movements, your portfolio may drift from its original asset allocation. Rebalancing involves adjusting the portfolio back to its target allocation to maintain the desired risk level.

- Selling overperforming assets

- Buying underperforming ones

- Helps maintain long-term investment discipline

Investment Management Styles

Active Management

Active managers seek to outperform the market by using research, forecasts, and judgment to make buy/sell decisions.

- Pros: Potential to outperform the market.

- Cons: Higher fees, more risk of underperformance.

Passive Management

Passive managers aim to replicate the performance of a market index (e.g., S&P 500) by investing in a similar portfolio.

- Pros: Lower fees, consistent market-matching returns.

- Cons: No attempt to outperform; you ride out market downturns.

What Is Financial Planning?

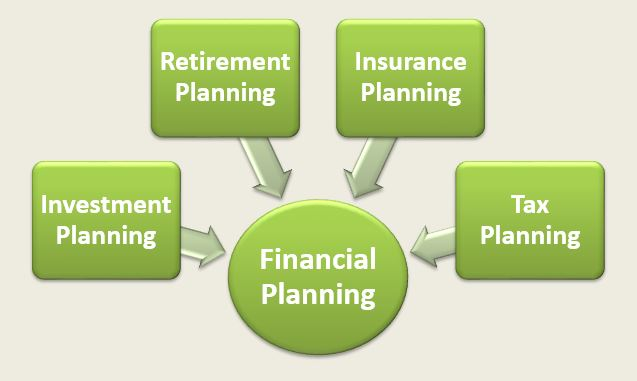

Financial Planning is a comprehensive process that evaluates an individual’s entire financial picture and outlines strategies to achieve long-term financial goals. It encompasses budgeting, saving, retirement planning, tax strategies, estate planning, and risk management.

Key Components:

- Budgeting: Creating a plan to manage income and expenses.

- Debt Management: Strategies to reduce and manage debt effectively.

- Retirement Planning: Preparing financially for retirement years.

- Tax Strategies: Planning to minimize tax liabilities.

- Estate Planning: Preparing for the transfer of assets after death.

Key Differences Between Investment Management and Financial Planning

| Aspect | Investment Management | Financial Planning |

|---|---|---|

| Scope | Focuses on managing investment portfolios. | Encompasses all aspects of an individual’s financial life. |

| Objective | Aims to maximize returns on investments. | Seeks to achieve long-term financial goals and stability. |

| Time Horizon | Typically shorter-term, focusing on market cycles. | Long-term, considering life stages and goals. |

| Risk Management | Diversification and asset allocation strategies. | Includes insurance, emergency funds, and estate planning. |

| Customization | Tailored investment strategies based on risk tolerance. | Personalized financial plans considering individual goals. |

How They Work Together

While distinct, Investment Management and Financial Planning are complementary:

- Financial Planning lays the foundation by setting goals and creating a roadmap.

- Investment Management implements the investment strategies to achieve those goals.

For instance, a financial plan might identify the need for retirement savings, and investment management would determine the best investment vehicles to accumulate those savings.

Aslo Read : What Is Investment Planning And Why Is It Important For Your Financial Future?

Conclusion

Understanding the distinction between Investment Management and Financial Planning is crucial for effective financial management. While investment management focuses on growing your wealth through strategic investments, financial planning ensures that all aspects of your financial life are aligned to achieve your long-term goals. Integrating both can provide a holistic approach to financial success.

FAQs

- Can I manage my investments without financial planning?

- While possible, it’s not advisable. Without a comprehensive plan, investment decisions may lack direction and purpose.

- Do I need both services?

- Yes. Financial planning provides the roadmap, and investment management executes the investment strategy to reach the destination.

- Are these services offered by the same professional?

- Some financial advisors offer both services, but it’s essential to ensure they have expertise in both areas.

- How often should I review my financial plan and investments?

- Financial plans should be reviewed annually or after significant life events. Investment portfolios should be monitored regularly, at least quarterly.

- What qualifications should I look for in a financial advisor?

- Look for certifications like CFP (Certified Financial Planner) for financial planning and CFA (Chartered Financial Analyst) for investment management.

- Can I start with just investment management?

- It’s possible, but without a plan, you might miss opportunities to align investments with broader financial goals.

- How do fees differ between the two services?

- Investment management fees are often based on assets under management, while financial planning fees can be hourly, flat-rate, or a percentage of assets.