Investment is the engine that powers personal financial growth. Whether you’re saving for retirement, funding a child’s education, or looking to grow your wealth, investing is essential. However, not all investments are equal—some are known for their safety and steady returns, while others are risky but hold the potential for high rewards.

Understanding the safest and riskiest types of investment is crucial for building a well-balanced portfolio. This article explores various types of investments, their potential returns, risks, and ideal investors. Whether you’re a conservative saver or a bold trader, knowing where to allocate your money can be the difference between financial success and failure.

Key Takeaways

- Safe investments offer security and steady returns, but lower growth.

- Risky investments can offer high returns but may lead to significant losses.

- Choose your mix based on your goals, time horizon, and risk tolerance.

- Diversification is the most effective way to manage investment risk.

- Regularly review and adjust your portfolio as your life circumstances change.

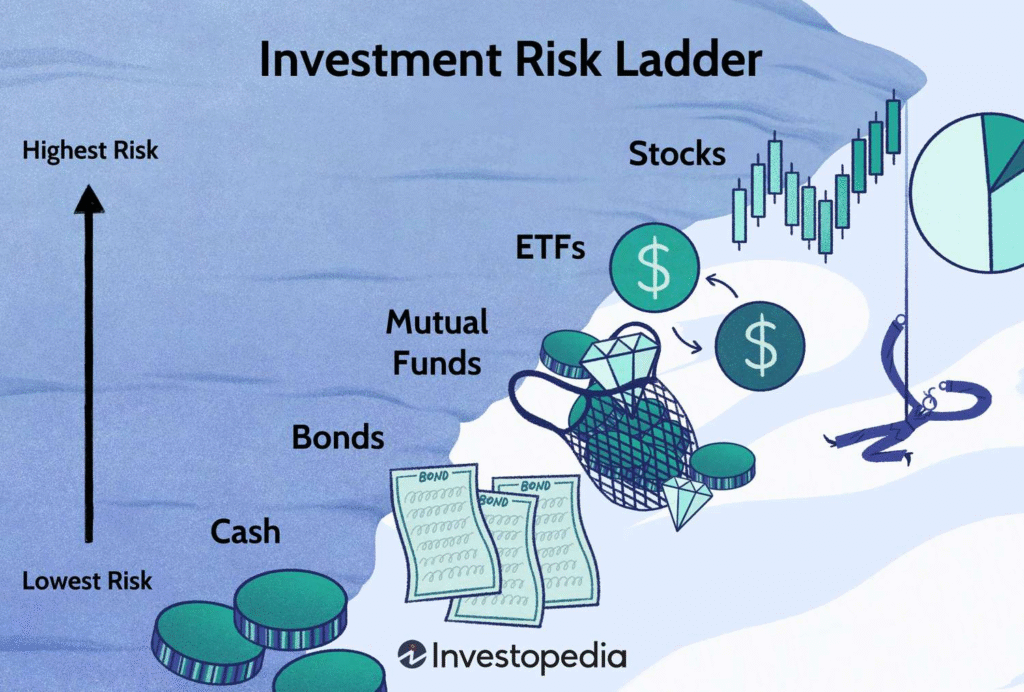

What Makes an Investment Safe or Risky?

Before diving into specific investment types, it’s important to understand what we mean by “safe” and “risky.”

Safe Investments:

- Preserve your capital

- Generate steady, modest returns

- Are generally backed by government or stable institutions

- Offer low volatility

- Are ideal for risk-averse investors or short-term goals

Risky Investments:

- Can lead to large losses (or gains)

- Are highly volatile or speculative

- Offer high potential returns

- Often depend on market timing or external factors

- Are best for investors with high risk tolerance and long time horizons

Safest Types of Investment

Here are some of the most secure places to park your money:

1. Government Bonds

Government bonds are loans you give to a government in exchange for regular interest payments. These include U.S. Treasury Bonds, UK Gilts, or German Bunds.

Why it’s safe: Backed by governments. U.S. Treasury securities, for instance, are considered virtually risk-free.

Returns: 2–5% annually

Best for: Long-term conservative investors or retirees

2. Certificates of Deposit (CDs)

A CD locks in your money for a set term (from a few months to several years) in exchange for fixed interest.

Why it’s safe: FDIC-insured in the U.S. up to $250,000 per depositor.

Returns: 2–5%, depending on the term length and interest rate

Best for: Short-term savers or those who don’t need immediate access to funds

3. High-Yield Savings Accounts

These are online or specialized bank accounts that pay more interest than regular savings.

Why it’s safe: Insured by the FDIC or equivalent institutions

Returns: 1.5–4% annually

Best for: Emergency funds, short-term savings, or low-risk interest accumulation

4. Money Market Funds

These funds invest in short-term, high-quality investments issued by government or corporations.

Why it’s safe: Diversified, highly liquid, and managed by professionals

Returns: 1–3% on average

Best for: Investors looking for safety and better returns than traditional savings accounts

5. Dividend-Paying Blue-Chip Stocks

These are shares in large, stable companies with a history of paying dividends.

Why it’s relatively safe: These companies often have strong balance sheets and predictable earnings

Returns: 4–10% annually including dividends

Best for: Investors seeking a mix of stability and growth

Riskiest Types of Investment

The investments below offer higher potential returns—but with significantly greater risk.

1. Cryptocurrencies

Digital currencies like Bitcoin, Ethereum, and Solana are decentralized and traded globally.

Why it’s risky: Extreme volatility, lack of regulation, potential for total loss

Returns: 1000%+ possible; losses can be total

Best for: Tech-savvy investors with high risk tolerance

2. Penny Stocks

Stocks trading under $5 are often from small companies with uncertain financials.

Why it’s risky: High volatility, low liquidity, prone to fraud or hype

Returns: High if timed correctly, but very speculative

Best for: Speculative investors or day traders

3. Venture Capital or Startup Investing

Investing in early-stage private companies offers incredible upside if they succeed.

Why it’s risky: Over 90% of startups fail; returns are illiquid for years

Returns: Massive potential ROI, but limited access and high failure rates

Best for: Accredited investors, angels, or VCs

4. Options and Futures Trading

These derivatives allow you to speculate on the future price of assets like stocks or commodities.

Why it’s risky: Highly leveraged; timing is critical

Returns: High if strategic, but losses can exceed the original investment

Best for: Expert traders with deep knowledge and risk appetite

5. Real Estate in Emerging Markets

Property in developing countries or volatile regions can offer big upside.

Why it’s risky: Unstable economies, political risk, foreign regulations

Returns: Can be high in boom cycles, but hard to exit in downturns

Best for: Experienced investors with local knowledge

Comparing Safe vs. Risky Investments

| Investment Type | Risk Level | Typical Return | Liquidity | Best For |

|---|---|---|---|---|

| Government Bonds | Very Low | 2–5% | Moderate | Capital preservation |

| CDs | Low | 2–5% | Low | Fixed savings goals |

| High-Yield Savings Accounts | Very Low | 1.5–4% | High | Short-term, emergency |

| Money Market Funds | Low | 1–3% | High | Conservative investors |

| Blue-Chip Dividend Stocks | Moderate | 4–10% | High | Long-term stability |

| Cryptocurrencies | Very High | Varies | High | High-risk traders |

| Penny Stocks | Very High | Varies | Low | Speculators |

| Startups/Venture Capital | Extreme | High-Varies | Very Low | Accredited investors |

| Options/Futures | Extreme | High-Varies | High | Advanced traders |

| Emerging Market Real Estate | High | Varies | Low | Experienced investors |

How to Choose the Right Investment for You

1. Know Your Financial Goals

- Short-Term Goals: Go safe (e.g., savings, CDs, bonds)

- Long-Term Goals: Accept some risk (e.g., stocks, real estate)

2. Understand Your Risk Tolerance

- Are you comfortable seeing your investment drop 30% overnight?

- Do you panic during market downturns?

Choose investments that align with your psychological and financial ability to absorb losses.

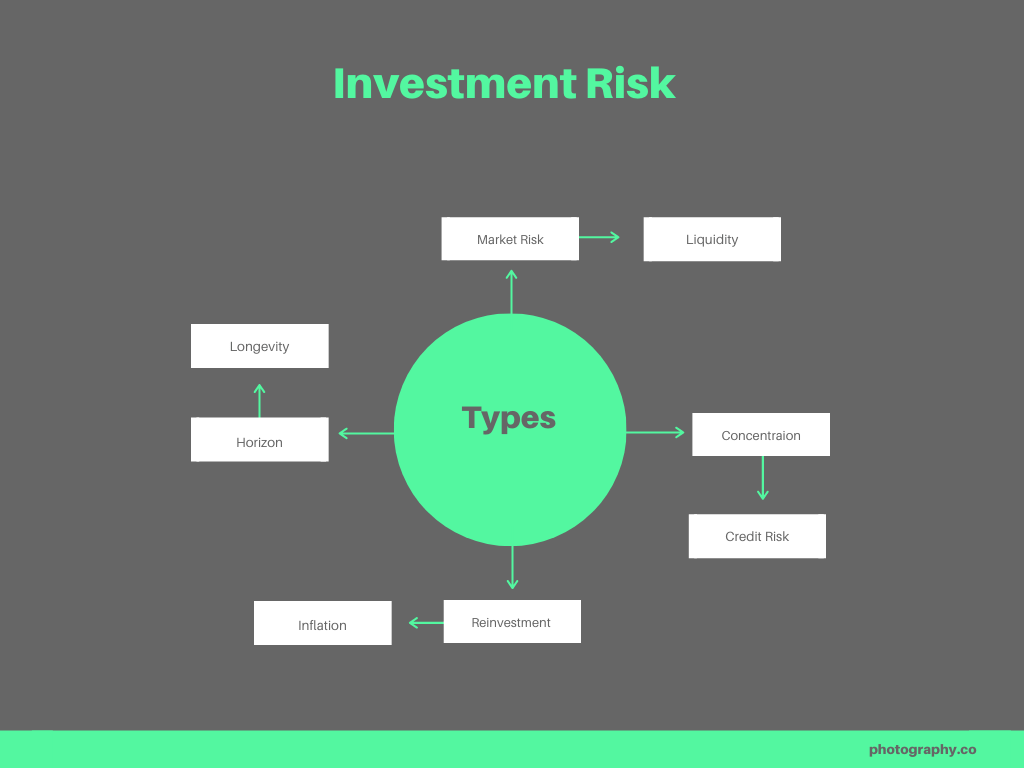

3. Diversify Your Portfolio

Don’t put all your money into one asset. Combine safe and risky investments to manage overall portfolio risk.

4. Keep a Long-Term Perspective

High returns often require time. Avoid panic selling during downturns.

5. Reassess Regularly

Your goals, income, and risk tolerance may change. Rebalance your portfolio as needed.

Also Read :- Best countries for international MBA programs in 2025

Conclusion

Every investment carries some level of risk. The key is understanding which assets align with your financial goals and risk tolerance. Safe investments like government bonds and CDs help protect your capital, while riskier assets like cryptocurrencies and startups offer potentially higher—but less certain—returns.

You don’t have to choose between all safe or all risky. The best portfolios balance both, giving you stability and growth potential over time. With the right strategy, awareness, and discipline, you can make investment work for your future.

FAQs

1. What is the safest type of investment?

U.S. Treasury Bonds and FDIC-insured savings accounts are considered the safest.

2. Are risky investments worth it?

They can be if they match your goals and you understand the potential downside. Risky investments can lead to high rewards, but also significant losses.

3. Can I invest in both safe and risky assets?

Absolutely. A balanced portfolio should have a mix of both to reduce overall risk.

4. Is real estate safe or risky?

It depends on the location and economic conditions. U.S. rental properties can be relatively safe; overseas properties are riskier.

5. Are stocks risky?

They can be volatile in the short term, but historically provide strong long-term growth.

6. How much of my portfolio should be in risky assets?

That depends on your age, goals, and risk tolerance. A common rule of thumb: “100 – your age = % of risky assets.”

7. Are mutual funds safer than stocks?

Mutual funds are diversified by design, which reduces individual stock risk, making them safer than holding a single stock.